HOW TO STAKE

STAKING

What is Staking ?

When you stake your IBAT , they remain in your ownership . To earn rewards and get extra benefits to make passive income , for that you need to stake your IBAT for a certain period of time. This process is known as staking.

Benefits of Staking IBAT

The following are the benefits of IBAT staking:

- It’s an easy way to earn interest on your IBAT holdings.

- You don’t need any hardware for IBAT staking .

- Helps you generate passive income.

- Special benefits to IBAT stakers.

We’ve added decentralised flexible, and locked staking to our platform.

1. Flexible Staking: This type of staking allows users to lock a certain quantity of tokens on our platform and receive 12% APY on those tokens. Users can also re-stake the interest earned on those tokens and withdraw their funds at any moment.

2. Locked staking: In order to obtain greater APYs, a user must lock a specific number of tokens for a specific amount of time to receive whole percentage of APY. But if you wish to unstake before the locked period then a fees of 10% would be charged and the users will also not be rewarded as well for their staking.

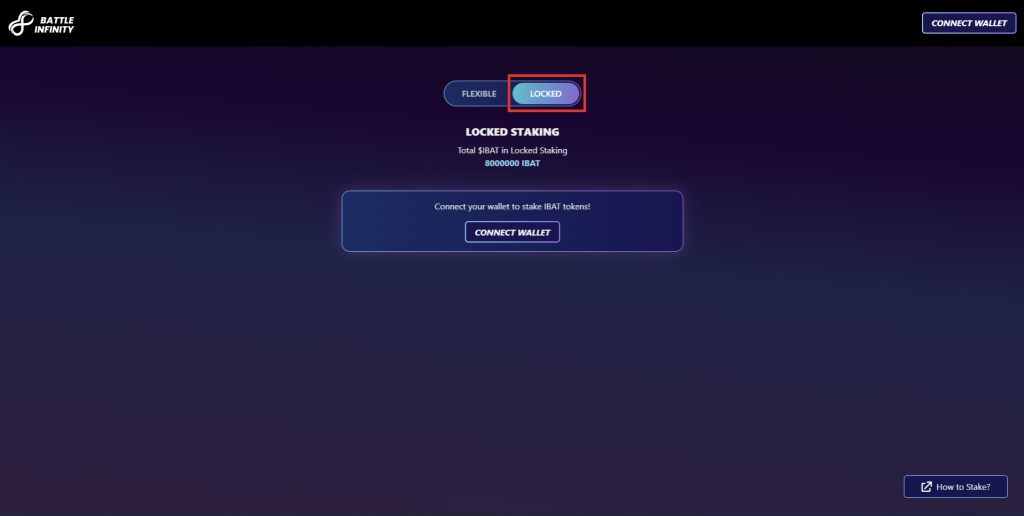

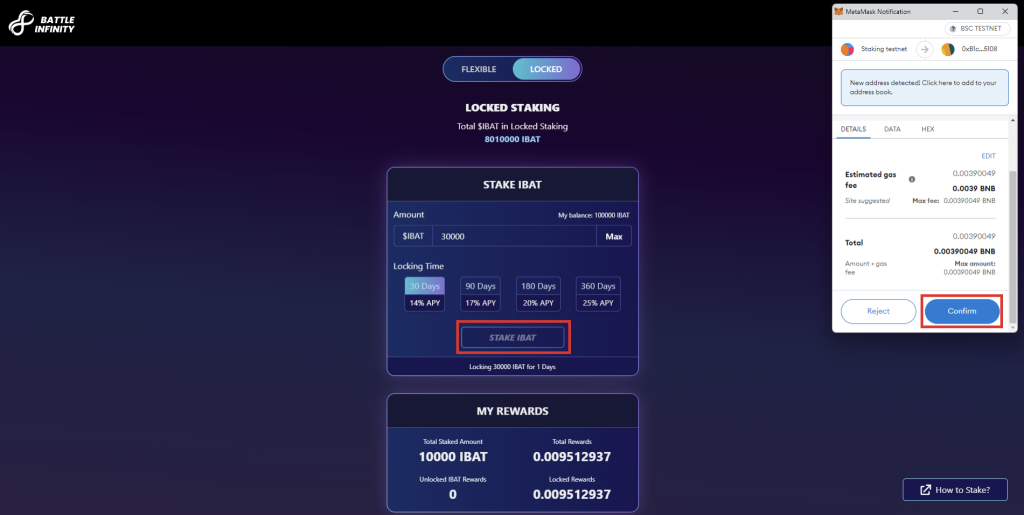

How to Stake in Locked Staking

1. Go to our Dapp area at dapp.battleinfinity.io.

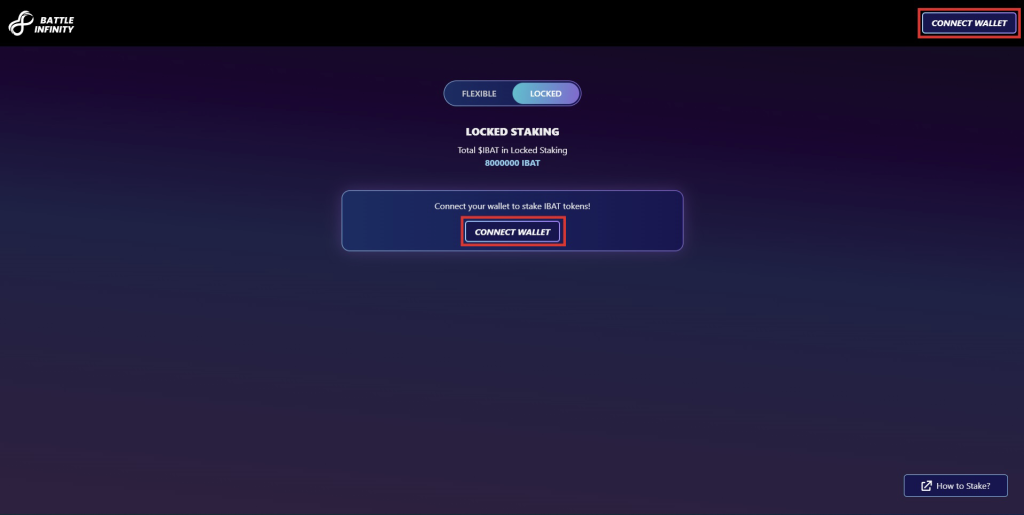

2. Click on “CONNECT WALLET” to connect your wallet.

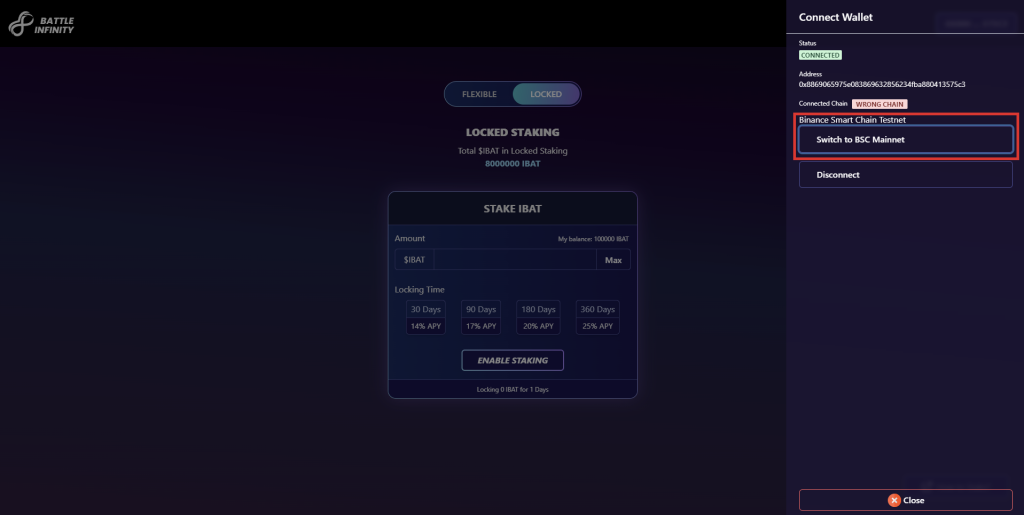

If you are not connected to the BSC network, click on “Switch to BSC network”

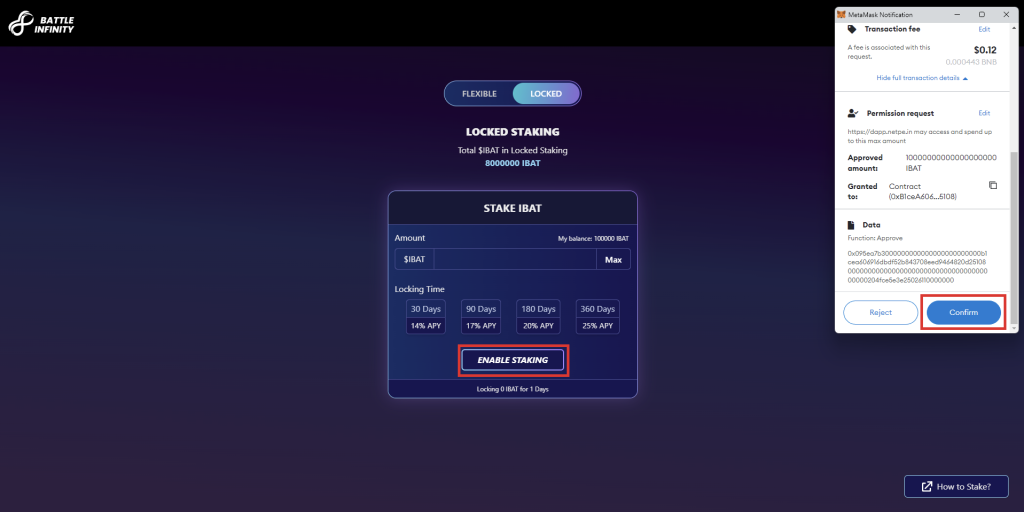

3. After connecting your wallet, click on “ENABLE STAKING” and Sign the transaction. Make sure you’re on Locked Staking. If you’re a first-time user, you will have to get the tokens approved. (GAS fees applicable)

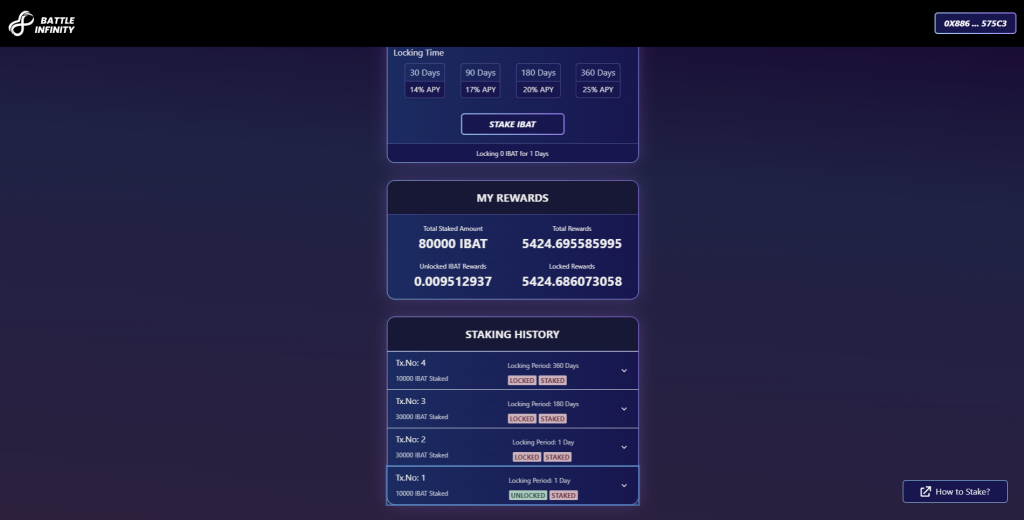

4. After enabling staking, you will be redirected to the locked staking page. Enter the amount you want to stake here.

Note: Minimum Ibat staking amount is 8000.

5. If you wish to check your staking history, you can check history section below

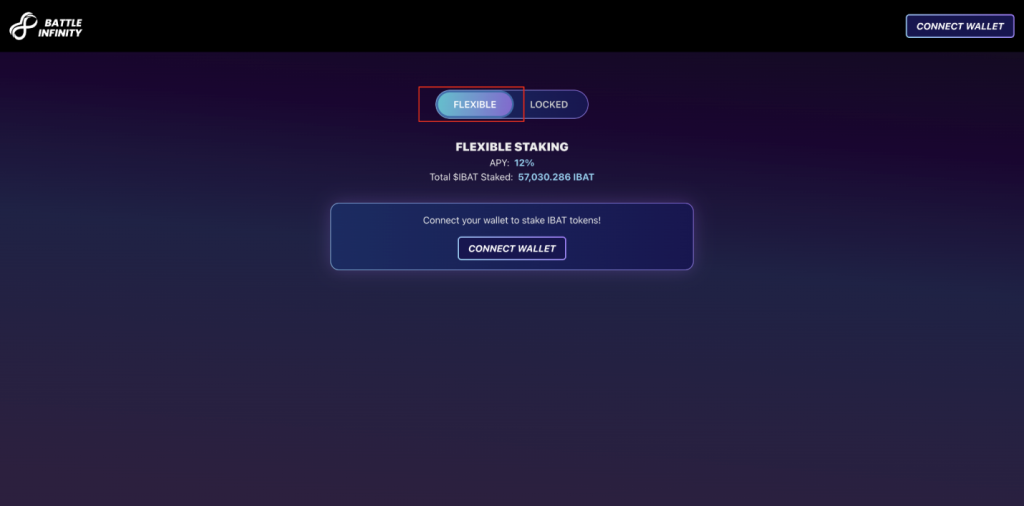

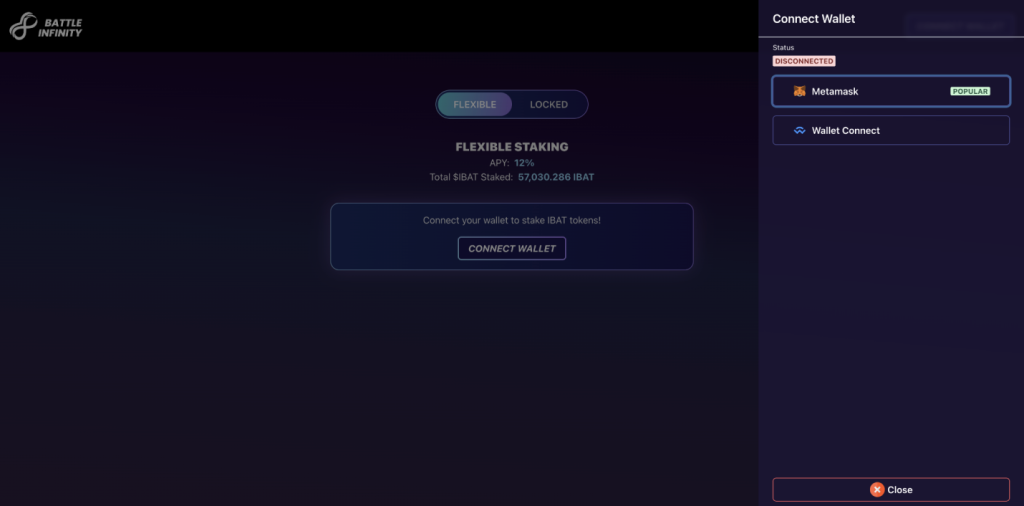

How to Stake in Flexible Staking

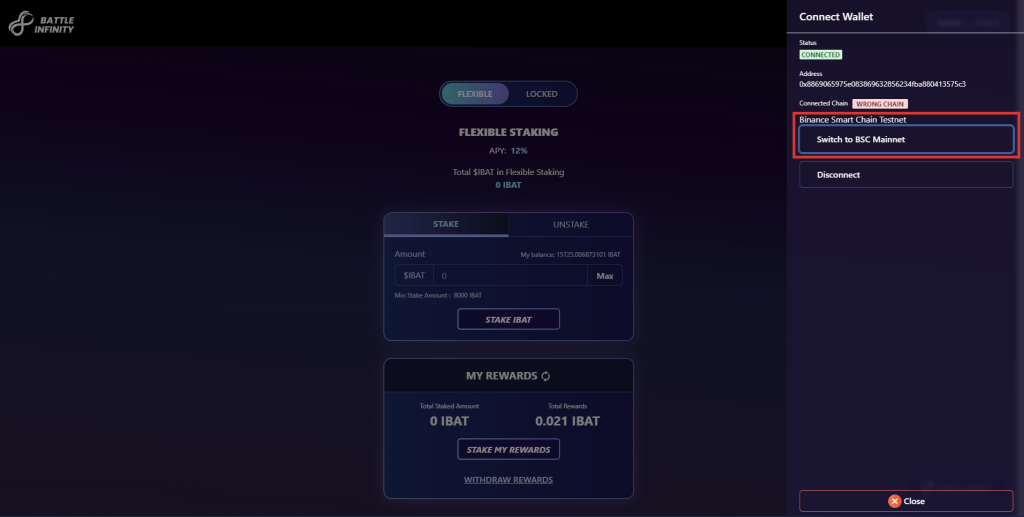

1.Go to our Dapp area at dapp.battleinfinity.io. Switch to Flexible staking

2. Connect to your wallet

If you are not connected to the BSC network, click on “Switch to BSC network”

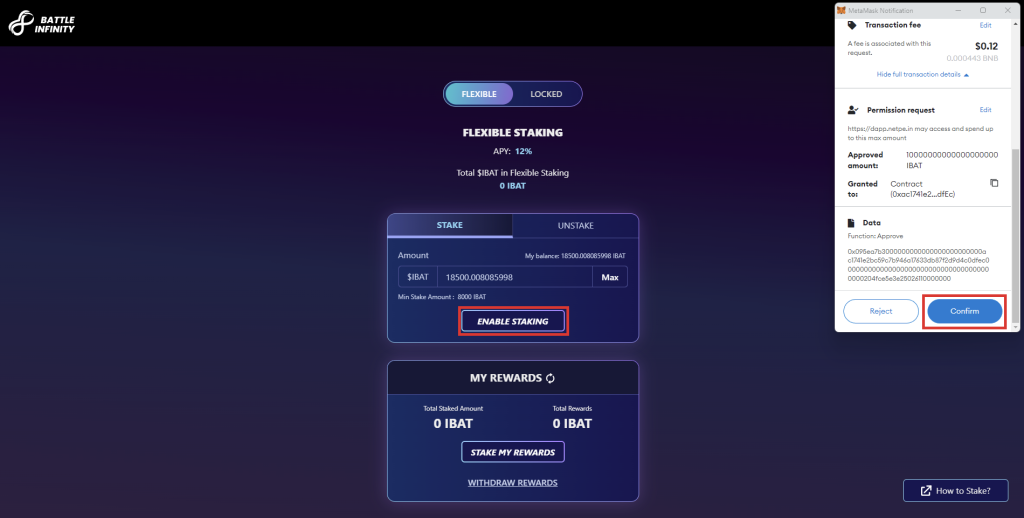

3. After connecting your wallet, click on “ENABLE STAKING” and Sign the transaction. Make sure you’re on Flexible Staking. If you’re a first-time user, you will have to get the tokens

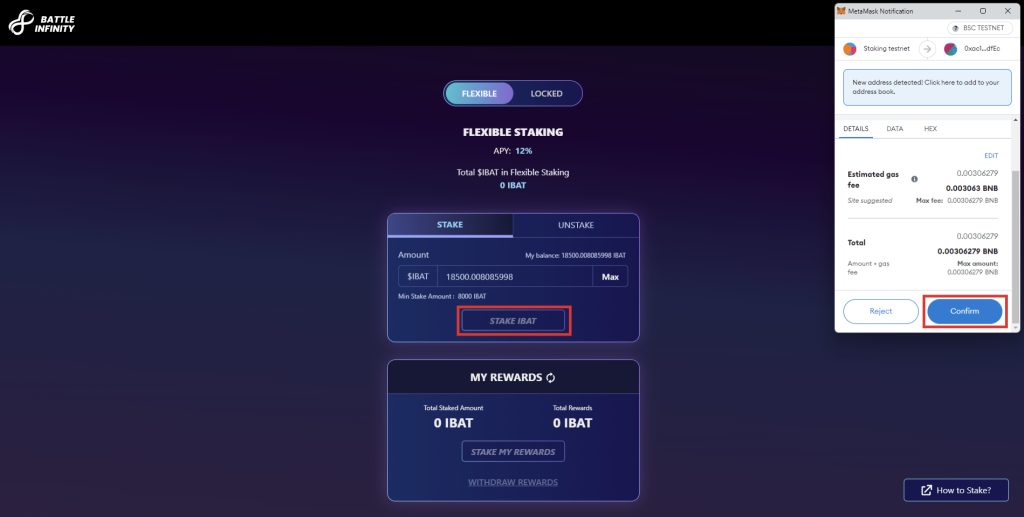

4. After enabling staking, you will be redirected to the flexible staking page. Enter the amount you want to stake here.

Note: Minimum Ibat staking amount is 8000.

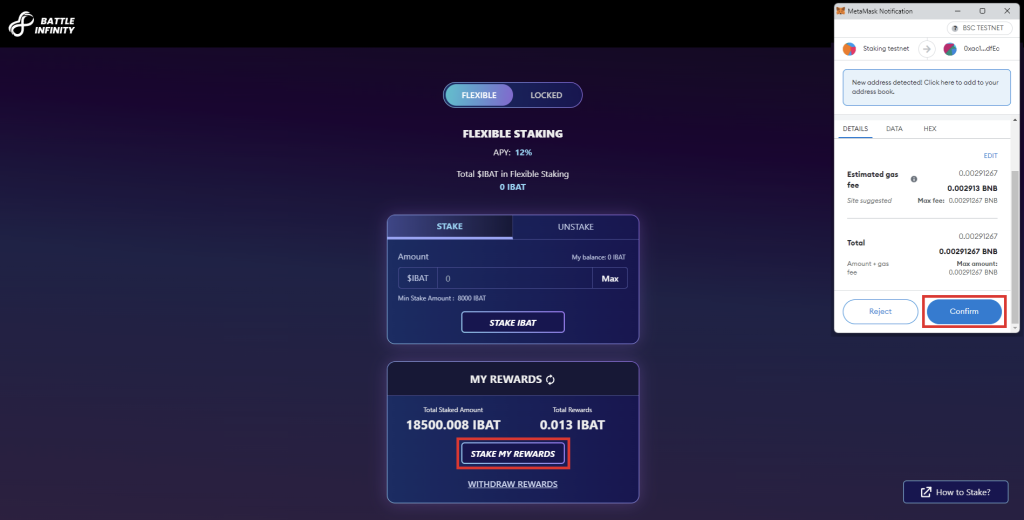

5. In flexible staking, you are free to Restake your rewards

APYs

What Is Annual Percentage Yield (APY) and How Does It Work?

The annual percentage yield (APY) is the actual rate of return on an investment that takes compounding interest into account. Compounding interest, as opposed to simple interest, is computed on a regular basis and the amount is instantly added to the balance. With each passing period, the account balance becomes a bit more, and so the interest paid on the balance grows as well.

HOW DOES IT WORK ?

If you are depositing $10 for a year at 25% interest and it was compounded every three months, you would have $12.74 at the end of the year. You would have received $12.50 if simple interest had been paid.

The APY would be ($10) * (1 +.25/4) (4 * 4).

The total amount accrued, principal plus interest, with compound interest on a principal of $10.00 at a rate of 25% per year compounded 4 times per year over 4 years is $26.38. The amount would have been $20 without compounding.

DIFFERENCE BETWEEN APY AND APR

APY is equivalent to the annual percentage rate (APR) used for loans. The APR is the effective percentage that the borrower will pay in interest and fees for the loan over the course of a year. Both APY and APR are standardised measurements of interest rates presented as an annualised percentage rate.

The difference between APY and APR is that the former considers compound interest. Furthermore, the APY equation does not include account fees, only compounding periods. This is a crucial factor for an investor, who must weigh any costs that will be deducted from the overall return on an investment.

What APY rate will you receive?

If you stake your IBAT to receive higher APYs then the following chart would help you decide you profits you wish to have :-

| TIME | NUMBER OF DAYS | APY % |

| Yearly | 360 | 25% |

| Half Yearly | 180 | 20% |

| Quarterly | 90 | 17% |

| Monthly | 30 | 14% |